Clark Wealth Partners - Truths

Table of ContentsAbout Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners Rumored Buzz on Clark Wealth PartnersThings about Clark Wealth PartnersThe 45-Second Trick For Clark Wealth PartnersGet This Report on Clark Wealth PartnersOur Clark Wealth Partners Ideas

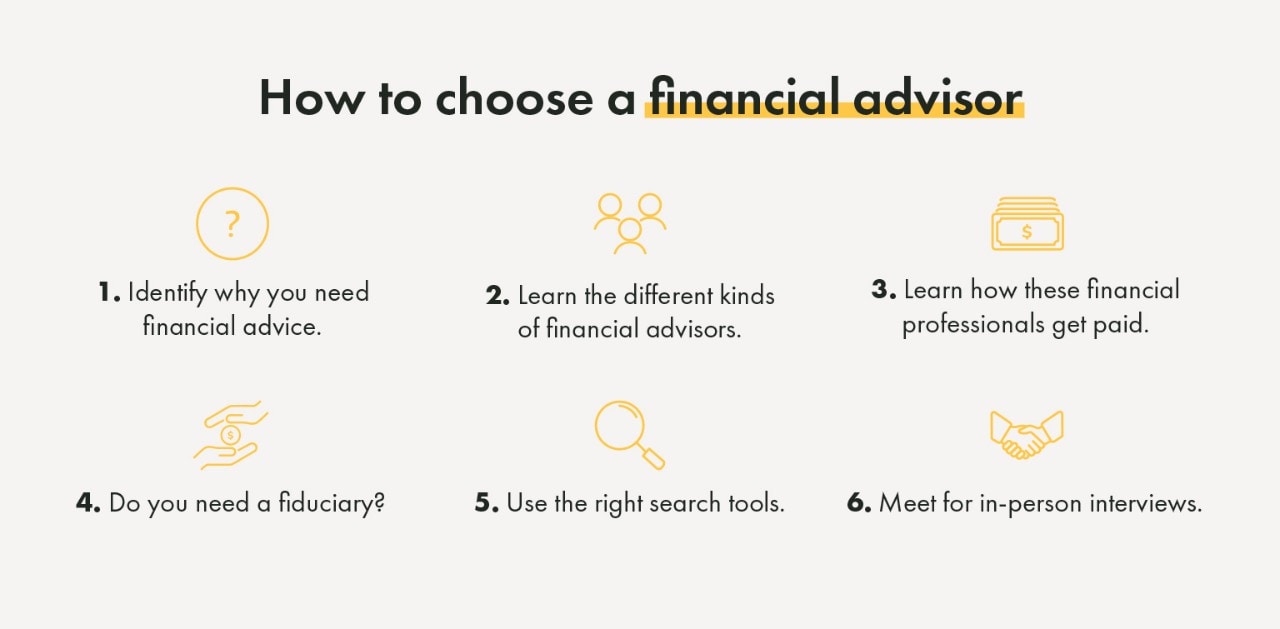

These are experts that provide investment suggestions and are registered with the SEC or their state's protections regulatory authority. NSSAs can assist seniors choose regarding their Social Protection benefits. Financial consultants can likewise specialize, such as in pupil finances, elderly demands, taxes, insurance and other aspects of your funds. The qualifications needed for these specialties can vary.Yet not always. Fiduciaries are lawfully called for to act in their customer's best interests and to maintain their money and building different from other properties they manage. Only financial advisors whose designation requires a fiduciary dutylike qualified monetary planners, for instancecan state the exact same. This distinction also implies that fiduciary and financial consultant cost frameworks differ as well.

The Facts About Clark Wealth Partners Revealed

If they are fee-only, they're more most likely to be a fiduciary. Many credentials and classifications call for a fiduciary obligation.

Choosing a fiduciary will certainly ensure you aren't steered toward certain financial investments as a result of the compensation they offer - civilian retirement planning. With lots of cash on the line, you might desire an economic specialist who is legitimately bound to make use of those funds meticulously and just in your finest rate of interests. Non-fiduciaries might suggest financial investment products that are best for their pocketbooks and not your investing objectives

Unknown Facts About Clark Wealth Partners

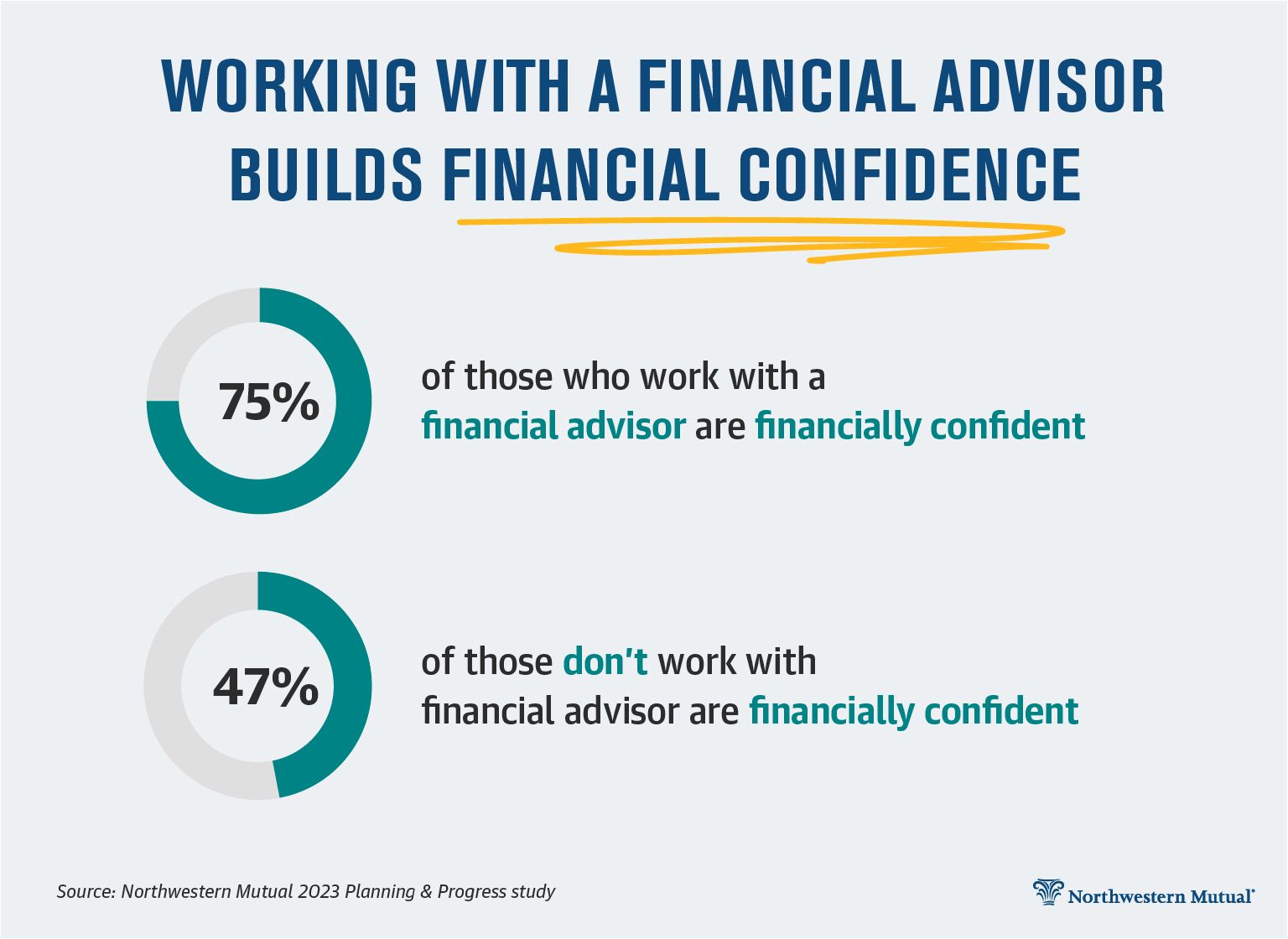

Review a lot more now on exactly how to maintain your life and cost savings in equilibrium. Boost in financial savings the ordinary home saw that dealt with a monetary expert for 15 years or even more contrasted to a similar household without an economic advisor. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "Extra on the Worth this of Financial Advisors," CIRANO Project News 2020rp-04, CIRANO.

Financial advice can be beneficial at turning points in your life. Like when you're starting a family members, being retrenched, preparing for retired life or taking care of an inheritance. When you meet an adviser for the very first time, exercise what you want to obtain from the advice. Before they make any recommendations, an adviser must take the time to discuss what is very important to you.

What Does Clark Wealth Partners Do?

Once you have actually consented to go on, your monetary adviser will certainly prepare a monetary prepare for you. This is offered to you at one more conference in a paper called a Statement of Advice (SOA). Ask the advisor to describe anything you don't understand. You need to always feel comfy with your advisor and their advice.

Insist that you are informed of all purchases, and that you receive all correspondence pertaining to the account. Your advisor might suggest a taken care of discretionary account (MDA) as a means of handling your investments. This involves authorizing an agreement (MDA agreement) so they can acquire or sell financial investments without having to get in touch with you.

The 10-Second Trick For Clark Wealth Partners

To safeguard your cash: Don't provide your advisor power of lawyer. Insist all correspondence concerning your investments are sent out to you, not simply your adviser.

This may occur during the conference or digitally. When you go into or restore the recurring fee setup with your advisor, they must define exactly how to end your partnership with them. If you're relocating to a brand-new advisor, you'll need to arrange to move your economic records to them. If you need help, ask your consultant to clarify the procedure.

will retire over the next years. To load their footwear, the nation will certainly require greater than 100,000 new financial consultants to enter the market. In their daily job, financial consultants manage both technical and innovative jobs. United State Information and Globe Record ranked the function amongst the leading 20 Finest Business Jobs.

What Does Clark Wealth Partners Mean?

Assisting individuals achieve their economic goals is a monetary advisor's primary feature. But they are additionally a local business proprietor, and a section of their time is devoted to managing their branch workplace. As the leader of their method, Edward Jones financial advisors require the leadership skills to work with and take care of team, in addition to the service acumen to develop and implement a company approach.

Financial experts spend some time everyday watching or reviewing market news on tv, online, or in trade magazines. Financial consultants with Edward Jones have the advantage of home office study teams that help them stay up to date on stock recommendations, shared fund monitoring, and a lot more. Investing is not a "set it and neglect it" task.

Financial consultants must arrange time each week to meet new people and capture up with the individuals in their ball. Edward Jones monetary consultants are privileged the home office does the heavy lifting for them.

A Biased View of Clark Wealth Partners

Edward Jones financial consultants are motivated to pursue extra training to expand their expertise and abilities. It's likewise an excellent concept for monetary experts to participate in market seminars.